Online Home Insurance Quote In today’s digital age, finding the right home insurance has become more convenient than ever. One of the simplest ways to explore your options is by requesting an online home insurance quote. With just a few clicks, you can receive estimates from multiple insurance providers, allowing you to compare coverage and pricing easily. However, while the process may seem straightforward, it’s important to understand what to look for in an online home insurance quote to ensure you choose the best coverage for your needs.

Online Home Insurance Quote This article will guide you through the essential factors you should consider when reviewing online home insurance quotes. We’ll discuss the different types of coverage, how to evaluate premiums, and what additional options might be necessary. Additionally, we’ll answer frequently asked questions to further clarify your home insurance decision-making process and help you select the right policy.

Key Takeaways

- Always review the coverage types and limits in your online quote.

- Don’t just focus on the premium; also consider deductibles and exclusions.

- Look for discounts and consider additional coverages like flood or earthquake protection.

- Check customer reviews to assess claims handling and service quality.

- Customize your policy to fit your specific needs, and ensure you understand the renewal process.

Also Read: Why Sustainability Should Be Your Top Priority?

Understanding Home Insurance Quotes

When you request an online home insurance quote, the insurance company will typically ask for some basic information, including details about your home, personal information, and coverage preferences. Once you’ve provided the required information, the insurance company will generate an estimate based on their underwriting guidelines, which reflect your home’s risk and other factors.

Also Read: How Can Sunscreen Help In Skin Cancer Prevention?

The online quote is just that – an estimate. The final premium can vary once an agent has reviewed your application and completed a full underwriting process. However, these quotes provide a good starting point for understanding what you might expect to pay for coverage and the types of protection available.

Also Read: The Best Sun Protection Ingredient For Your Skin Type

Key Factors to Look for in an Online Home Insurance Quote

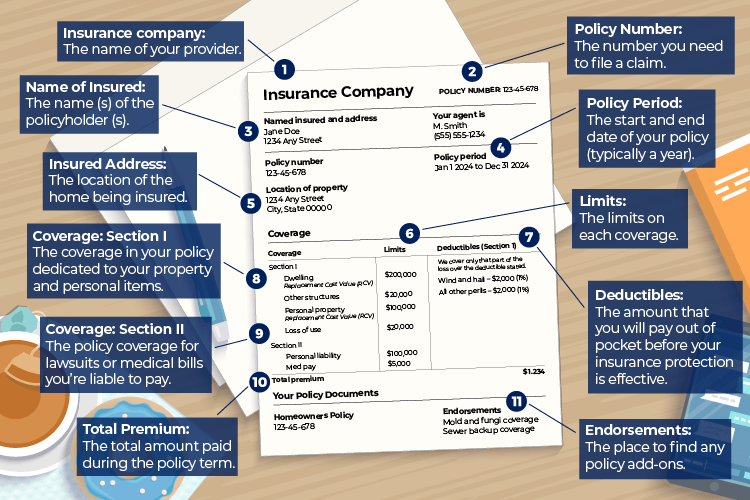

1. Coverage Types and Limits (Expanded)

- Dwelling Coverage: As mentioned, this protects the physical structure of your home. Ensure it covers the full cost to rebuild, not just the market value. The quote should reflect modern construction standards, as costs to rebuild can be significantly higher than the purchase price.

- Personal Property Coverage: Double-check the valuation method used (actual cash value vs. replacement cost). Actual cash value deducts depreciation, while replacement cost ensures you get the full cost to replace items with new ones.

- Liability Coverage: While standard liability limits might be set at $100,000, many experts recommend at least $300,000 or more, depending on your assets and risk level. Some policies even offer specific personal injury protection that covers legal expenses.

- Loss of Use (Additional Living Expenses): This helps if you need to stay somewhere else while your home is being repaired. Make sure the amount is sufficient to cover long-term living expenses, particularly if you live in an area with high rental costs.

Also Read: Top Sun Protection Ingredients You Need To Look For In Sunscreens

2. Premiums and Deductibles (Expanded)

- Premium Payment Options: Some insurers offer flexibility in how you pay your premium. For instance, you might be able to choose monthly, quarterly, or annual payments. Look for the payment structure that fits your financial situation.

- Adjusting Your Deductible: Raising your deductible can significantly reduce your premium. However, ensure that your deductible is not so high that it leaves you vulnerable financially if you need to make a claim. Consider a balance between manageable premium costs and an affordable deductible.

3. Discounts and Savings (Expanded)

- Claims-Free Discount: If you’ve never filed a claim in the past few years, many insurers offer a discount as a reward for being a low-risk policyholder.

- Protective Devices Discount: Discounts for smoke detectors, fire alarms, and sprinkler systems are common. Some insurers also offer savings for advanced home security systems, like cameras or smart locks.

- Senior Citizen Discount: Some insurers offer discounts to older homeowners or retirees. These discounts may be available even if you are not eligible for other typical savings.

- New Home Discount: If you’re purchasing a new home, some insurers provide a discount due to the fact that newer homes generally require fewer repairs and are less likely to experience damage.

- Green Home Discount: For homeowners who have made energy-efficient upgrades, some insurers offer discounts. This might include things like solar panel installations, energy-efficient appliances, or eco-friendly building materials.

4. Coverage Exclusions (Expanded)

- Maintenance-Related Damage: Home insurance generally does not cover damage due to neglect or lack of maintenance, such as wear and tear or mold resulting from poorly maintained plumbing. Ensure that your policy covers common maintenance issues if needed.

- High-Value Items: Standard home insurance policies might limit coverage on valuable items such as art, jewelry, and collectibles. If you own high-value property, ask for endorsements to cover these items properly.

- Home-Based Business: If you operate a business from home, such as an office or online store, you may need additional coverage. Home insurance policies usually don’t cover business-related risks like inventory loss or client injury.

- Homeowners Liability in Certain Scenarios: If you have a pool, trampoline, or other high-risk features, check whether your policy offers comprehensive liability protection for these items. You might need to purchase additional liability coverage or endorsements.

5. Claims Process and Customer Service (Expanded)

- Claims Satisfaction: Look at reviews of how the insurer handles claims. Some insurers are known for paying out claims quickly and efficiently, while others may delay payments or require more documentation. Choose an insurer with a reputation for good customer service and fast claims processing.

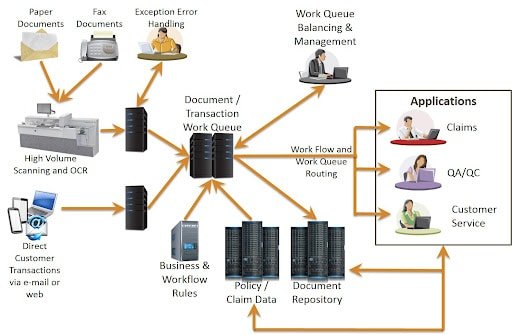

- Claims Support and Communication Channels: Does the insurer offer 24/7 claims support? Can you file claims through an app or online portal, or do you have to call or mail in your claim? Convenience can make a big difference when you need to file a claim.

- Policy Updates and Maintenance: Consider whether your insurer allows easy adjustments to your policy as your needs change. Some insurers allow you to adjust coverage limits or update your policy details directly from your online account.

6. Policy Customization Options (Expanded)

- Scheduled Personal Property: If you have high-value items, such as antiques or electronics, look for options to schedule specific items under your policy. This ensures they’re fully covered for their full value, without limitations based on the general policy limits.

- Home Renovations or Additions: If you’re planning renovations, additions, or significant changes to your home, check whether your online quote allows you to adjust coverage during construction. Home improvements may change your risk profile and, therefore, your insurance needs.

- Flood and Earthquake Coverage: These are not typically included in standard home insurance policies. If you live in an area prone to flooding or earthquakes, look for policies that offer these as optional add-ons or separate policies.

- Short-Term Rental Coverage: If you rent out your home or part of it on platforms like Airbnb, make sure your policy includes coverage for short-term rentals. Traditional homeowners insurance may not cover damages caused by renters.

7. Policy Renewals and Rate Increases (Expanded)

- Rate Lock Options: Some insurers offer a rate lock for a set number of years, ensuring that your premiums won’t increase during that time. If stability in your premium pricing is a concern, ask about these options.

- Review and Adjustments: Inquire about how often your insurer reviews your policy and adjusts rates. Some insurers automatically increase rates after the first year, so it’s essential to review your policy at renewal to ensure that your coverage and premiums are still in line with your needs.

- Discounts Upon Renewal: Ask if your insurer offers renewal discounts for being a loyal customer. Some insurers reward long-term policyholders with lower premiums upon renewal.

8. Reputation and Financial Strength of the Insurer

- Company Reputation: Research the insurer’s reputation in the industry. Customer satisfaction ratings, reviews, and the company’s history in claims handling can give you insight into how they operate.

- Financial Strength Ratings: You want to make sure the insurer has the financial stability to pay claims, especially if disaster strikes. Companies like A.M. Best, Fitch, or Standard & Poor’s provide ratings that indicate an insurer’s financial strength.

- Complaints History: Check for any red flags related to complaints or poor claims handling. The National Association of Insurance Commissioners (NAIC) provides insight into how many complaints have been filed against an insurer in a given period.

9. Availability of Additional Coverage Options

- Identity Theft Protection: Many insurers now offer identity theft protection as an optional add-on. This can help you recover in case your personal information is stolen and used fraudulently.

- Pet Insurance Add-Ons: Some home insurance policies offer optional pet insurance or liability coverage for pets that might cause damage to your property or injury to others.

- Home Warranty Options: Some insurance providers offer a home warranty as an add-on to your policy, which can cover repairs and maintenance for things like appliances and HVAC systems.

- Cyber Liability: With more homeowners connecting their devices to the internet, cyber liability coverage has become a valuable option for those worried about digital threats or data breaches.

10. Digital Tools and Technology Integration

- Mobile App Integration: Does the insurer offer a mobile app that allows you to manage your policy, file claims, and get instant support? A convenient app can make managing your policy and accessing services more efficient.

- Online Account Management: Check if the insurer provides an easy-to-use online portal where you can view your policy, track claims, make payments, and request policy changes at your convenience.

- Smart Home Integration: Some insurers offer discounts or incentives for smart home devices, such as smart thermostats, security cameras, or water leak detectors. If you have smart devices, check if your insurer offers any integration or discounts related to them.

11. Customer Support Accessibility

- 24/7 Support Availability: Ensure that the insurer provides round-the-clock support, especially in the case of emergencies or claims. Having access to customer service at any time can be crucial when dealing with home damage or issues that require immediate attention.

- Multiple Communication Channels: Check if the insurance company offers several ways to reach out for assistance. This includes phone support, online chat, email, or even social media customer service. The more options available, the easier it will be to get help when you need it.

- Dedicated Claims Assistance: Some insurers provide specific claims support, offering you direct access to an agent who will walk you through the entire process. This can be especially beneficial during a stressful event like property damage.

12. Coverage for Detached Structures

- Detached Structures: Look at whether the quote includes coverage for detached structures on your property, such as garages, sheds, fences, and gates. Often, a standard home insurance policy might only cover structures attached to the house (like a garage that is part of the main house). If you have valuable detached structures, ensure they’re properly covered.

- Coverage Limits for Detached Structures: Make sure that the coverage amount for these structures is adequate, and if necessary, ask for additional coverage to protect them from damage or loss.

13. Impact of Local Risks and Natural Disasters

- Risk Exposure: The location of your home significantly influences your online home insurance quote. Ensure that the insurer takes into account any local risks such as hurricanes, wildfires, tornadoes, or other regional threats. For example, if you live in a flood zone, you’ll need to check if flood insurance is available, as it’s not typically included in standard policies.

- Regional Pricing Adjustments: Depending on where you live, home insurance premiums can fluctuate dramatically due to factors like crime rates, natural disaster risks, or proximity to fire services. Be aware of how these elements influence your quote and whether there are any adjustments based on your location.

14. Rebuilding Costs vs. Market Value

- Accurate Valuation for Rebuilding: Make sure the quote reflects the true rebuilding cost of your home, which includes labor and materials to rebuild your house to its previous condition. This is different from the market value, which is based on how much your home would sell for on the open market.

- Inflation Protection: Some insurers offer inflation protection, which automatically adjusts your coverage limits to keep pace with rising construction costs. This is an important feature if you live in an area where building costs are increasing rapidly.

15. Time of Year and Policy Term Considerations

- Policy Term Length: Review how long the policy term is. Most Policy are issued for a one-year period, but you should know whether your insurer offers long-term policies with fixed premiums for multiple years.

- Seasonal Considerations: Certain times of year may bring higher risks, such as winter storms, floods, or wildfires. You might want to ask your insurer if the premium changes seasonally or if there are ways to adjust your coverage for specific seasonal risks.

Also Read: Top Home Insurance Coverage Options To Protect Your Property

Conclusion

Getting an online home insurance quote is a convenient and efficient way to explore your coverage options, but it’s important to carefully evaluate the quote to ensure it meets your needs. By looking at coverage types, premiums, exclusions, customer service, and policy customization, you can make an informed decision about which insurer and policy are the best fit for your home.

While an online quote provides a great starting point, it’s crucial to do your research and possibly consult with an agent before finalizing your decision. With the right coverage, you can have peace of mind knowing that your home is protected against a variety of risks.

7 FAQs

How do I get an accurate online home insurance quote?

To get an accurate quote, provide as much detail as possible about your home, including its age, size, location, construction type, and any safety features. The more information you provide, the more accurate your quote will be.

Can I trust an online home insurance quote?

Online quotes are estimates based on the information you provide, so they can give you a good idea of pricing. However, the final premium may differ once a full review is conducted by the insurance company.

What factors affect the cost of my home insurance premium?

Several factors affect your premium, including your home’s value, location, deductible, coverage limits, claims history, and the safety features of your property.

How can I save money on my home insurance quote?

You can save money by bundling your home and auto insurance, raising your deductible, installing home security features, and maintaining a good credit score.

Can I customize my home insurance coverage?

Yes, many insurers offer additional coverage options and endorsements to customize your policy to better suit your needs.

What should I do if I’m not satisfied with my online quote?

If you’re not satisfied with the quote, you can adjust coverage limits, deductibles, or explore other insurers for a better deal.

Are there any discounts available for online home insurance quotes?

Yes, insurers often offer discounts for bundling policies, installing home security systems, or having a claim-free history.