Home insurance is a necessity for homeowners, providing financial protection in the event of damage to your property or belongings, or if someone is injured on your premises. However, the price of home insurance premiums can vary significantly depending on various factors, such as location, coverage limits, and the insurance provider. With so many options available, it’s essential to compare home insurance policies to find the best deal that balances cost and coverage. In this detailed guide, we will explore the critical factors you should evaluate when comparing home insurance policies to maximize savings while ensuring that you have the right protection in place.

Key Takeaways

- Compare multiple quotes: Get quotes from at least three to five insurance providers to ensure you’re getting the best deal.

- Understand your needs: Make sure the coverage limits and exclusions meet your specific requirements.

- Balance cost with coverage: Don’t just focus on premiums—ensure you have enough protection for your home, belongings, and liability.

- Research the insurer’s reputation: Customer service and claims handling are essential factors to consider when comparing policies.

- Take advantage of discounts: Look for opportunities to save money, such as bundling policies or installing safety features.

Why Is It Important to Compare Home Insurance Policies?

The importance of comparing home insurance policies cannot be overstated. Home insurance is not just a financial safety net; it also provides peace of mind, knowing that your property, possessions, and liability are covered in case of unexpected events. However, different policies offer varying coverage options, exclusions, and pricing. By comparing policies, you can:

- Ensure adequate coverage: You don’t want to pay for coverage you don’t need, but you also don’t want to risk being underinsured.

- Identify potential savings: Many insurance companies offer discounts and customizable plans that could lower your premiums while still providing the protection you need.

- Choose the best provider: Not all insurance companies are the same. Some may offer better customer service or easier claims processing, which can make a significant difference in your experience.

Key Factors to Compare When Shopping for Home Insurance

To make an informed decision when comparing home insurance policies, it’s crucial to evaluate several factors carefully. Let’s explore these factors in more detail:

1. Coverage Types and Limits

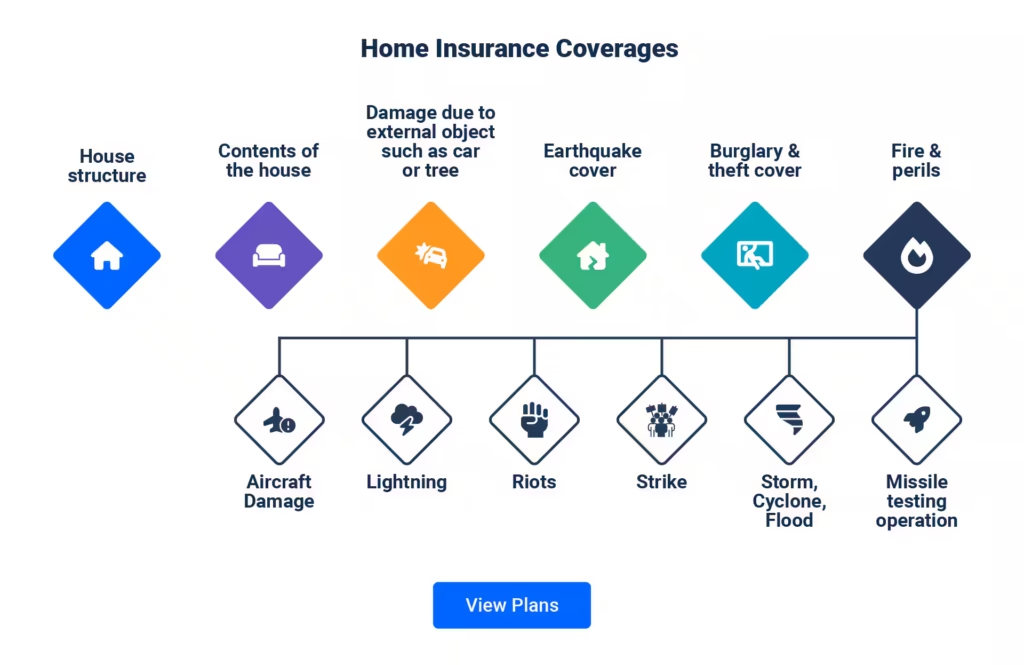

One of the first things to compare when reviewing home insurance policies is the type and amount of coverage provided. Home insurance policies generally cover the following areas:

- Dwelling Coverage: This protects the physical structure of your home from damage due to natural disasters, fires, vandalism, or accidents.

- Personal Property Coverage: Covers your personal belongings, such as furniture, electronics, clothes, and even jewelry, if they’re damaged, destroyed, or stolen.

- Liability Coverage: If someone is injured while on your property and sues you, this coverage protects you financially.

- Loss of Use Coverage: If your home becomes temporarily uninhabitable due to damage, this coverage helps pay for additional living expenses, such as hotel bills and meals.

Different policies may offer higher or lower coverage limits, so it’s essential to review each policy carefully to ensure you’re not underinsured, especially if you own high-value items or live in an area prone to natural disasters.

Example:

Let’s say one policy covers your dwelling for $200,000, while another covers it for $250,000. While the second option may cost more, it provides better protection if your home is in an area with frequent storms or if construction costs are high.

2. Premium Costs

The premium is the amount you pay your insurance company for coverage. While comparing premiums, be mindful that a lower premium may not always equate to better value. It’s essential to consider the following:

- The coverage level: Ensure that a low premium isn’t due to insufficient coverage.

- Location: If you live in an area that’s prone to natural disasters, high crime rates, or other risks, you may face higher premiums.

- Deductible: A higher deductible can lead to lower premiums, but you’ll need to be able to afford the deductible in case you need to file a claim.

Example:

Policy A has a lower premium but offers fewer coverage options, while Policy B has a higher premium but includes flood protection, a critical coverage for those living in flood-prone areas. By comparing both, you can decide if the higher premium for Policy B is worth the additional protection.

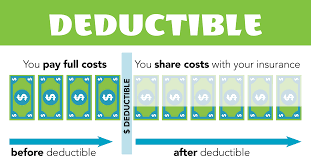

3. Deductibles

The deductible is the amount you must pay out of pocket before your insurance policy kicks in. Generally, policies with higher deductibles come with lower premiums because you’re taking on more of the financial risk. While it might seem attractive to choose a policy with a higher deductible to save on premiums, it’s important to assess whether you can afford the deductible in the event of a claim.

A lower deductible means higher premiums, but it could be a better choice if you anticipate needing to file claims or if you prefer to minimize your out-of-pocket expenses.

Example:

If you opt for a $1,000 deductible, you’ll likely pay less in premiums, but in the case of a claim, you’ll need to pay the first $1,000 out of pocket. However, if you choose a $500 deductible, your premium may increase, but your out-of-pocket expenses will be lower when filing a claim.

4. Policy Exclusions

Every home insurance policy has exclusions, or things that are not covered by the policy. It’s critical to thoroughly review these exclusions before deciding on a policy. Common exclusions in home insurance policies include:

- Flooding: Standard home insurance does not cover flood damage unless you purchase additional flood insurance.

- Earthquakes: Like flooding, earthquake damage is typically excluded and requires a separate policy or rider.

- Maintenance issues: Home insurance generally does not cover damage caused by a lack of maintenance or wear and tear.

Example:

If you live in an area with frequent floods or earthquakes, ensure that your home insurance policy provides additional coverage for these events. Otherwise, you might face significant out-of-pocket expenses in the event of a disaster.

5. Additional Coverage and Riders

Some insurance companies offer additional coverage options or riders to customize your home insurance policy. These riders can help protect valuable items that standard policies might not cover, including:

- Jewelry or Fine Art Riders: These provide extra protection for high-value items.

- Home Business Coverage: If you run a business from home, a rider may provide coverage for business-related property and liabilities.

- Flood or Earthquake Coverage: As mentioned, this is often not included in standard policies, but you can add it separately if needed.

Example:

If you have expensive jewelry, art, or collectibles, a standard home insurance policy may not offer adequate protection. Adding a rider for these valuables can help ensure that they are fully covered in case of loss, damage, or theft.

6. Customer Service and Claims Process

One of the most overlooked aspects when comparing home insurance policies is the quality of customer service and the ease of the claims process. Even if you find an affordable policy, poor customer service or a cumbersome claims process can lead to frustration when you need assistance the most.

- Claims handling: Research the claims process of each insurance provider and ensure it’s straightforward and efficient.

- Customer satisfaction: Look for customer reviews and ratings to gauge how well the company treats its clients.

Example:

An insurance company with an excellent reputation for handling claims quickly and efficiently might be worth paying a slightly higher premium for, especially if your area is prone to natural disasters.

7. Discounts and Special Offers

Most insurance companies offer various discounts that can significantly reduce your premium. Common discounts include:

- Bundling Discount: If you purchase multiple policies (e.g., home and auto insurance) with the same company, you may receive a discount.

- Security Features Discount: Installing safety features such as a home security system, smoke detectors, or a sprinkler system may qualify you for a discount.

- Loyalty Discount: Some insurance providers offer discounts to long-time customers who stay with them year after year.

Example:

If you bundle your home insurance with auto insurance, you could save 10-25% on both policies. Similarly, installing a security system might lower your home insurance premium by up to 10%.

How to Compare Home Insurance Policies for Maximum Savings

Now that we’ve explored the key factors to consider, here’s a step-by-step guide on how to compare home insurance policies to ensure you get the best deal.

Step 1: Assess Your Coverage Needs

Before comparing policies, assess what level of coverage you need. Consider the value of your home, the belongings you want to insure, and any additional coverage options you may require (such as flood or earthquake coverage). Understanding your specific needs will help you narrow down the policies that best suit you.

Step 2: Gather Quotes from Multiple Providers

Get quotes from at least three to five different home insurance companies. Most insurers allow you to obtain quotes online or over the phone. Make sure to provide the same information to each provider to ensure an apples-to-apples comparison.

Step 3: Evaluate Coverage and Exclusions

Review the coverage limits and exclusions of each policy. Make sure that the policy provides enough protection for your home, belongings, and liability, and check if any exclusions could be a concern. For example, if you live in an area prone to flooding, ensure flood insurance is included or available as an add-on.

Step 4: Compare Premiums and Deductibles

While comparing premiums, also assess the deductible associated with each policy. Sometimes, a slightly higher premium can be worthwhile if it means a lower deductible or more comprehensive coverage.

Step 5: Check the Insurance Provider’s Reputation

Look at customer reviews, BBB ratings, and J.D. Power rankings to assess the insurance company’s customer service and claims process. The quality of service provided by the Insurance is just as important as the price.

Step 6: Consider Discounts and Special Offers

Ask about available discounts, such as bundling or safety feature discounts. Some insurance providers offer significant savings for customers who install security systems, fire alarms, or other safety features.

Also Read: What Factors Affect The Cost Of Affordable Home Insurance?

Conclusion

Comparing home insurance policies is a critical step in ensuring that you’re getting the best coverage at the most competitive price. By carefully evaluating the factors like coverage types, premiums, deductibles, and exclusions, you can make an informed decision that balances cost with the protection your home deserves. Additionally, don’t forget to assess the insurer’s reputation for customer service and claims handling, and consider any available discounts that may help you save even more.

FAQs

What’s the most important factor when comparing home insurance policies?

- The most important factor is ensuring you have sufficient coverage for your home and belongings, but it’s also crucial to balance coverage with premium costs.

Can I save money by increasing my deductible?

- Yes, increasing your deductible can lower your premiums, but make sure you can afford to pay the deductible if you need to file a claim.

How do I know if my home is adequately insured?

- Assess the replacement cost of your home and personal belongings, and compare it with your policy limits. If you’re unsure, consider getting a professional appraisal.

What are common exclusions in home insurance policies?

- Common exclusions include flood damage, earthquake damage, and maintenance-related issues.

How often should I compare home insurance policies?

- It’s a good idea to compare home insurance policies annually, especially if your circumstances change or if you haven’t reviewed your policy in several years.

Can I switch home insurance providers mid-year?

- Yes, you can switch home insurance providers at any time. Just make sure that your new policy is in place before you cancel the old one to avoid gaps in coverage.

Does home insurance cover temporary living expenses if my home is damaged?

- Yes, most home insurance policies include loss of use coverage, which helps pay for temporary living expenses if your home becomes uninhabitable due to covered damage.